ad valorem tax calculator florida

The 90 varies by age 50 year prior 90 current model year 60 second year 40 third year 25 fourth year 10 fifth year and on. Title Ad Valorem Tax TAVT became effective on March 1 2013.

Florida Income Tax Calculator Smartasset

2 Enforce child support law on behalf of about 1025000 children with 126 billion collected in FY 0607.

. 3 Oversee property tax administration. This tax estimator is based on the average millage rate of all Broward municipalities. Ad Valorem Tax Exemption.

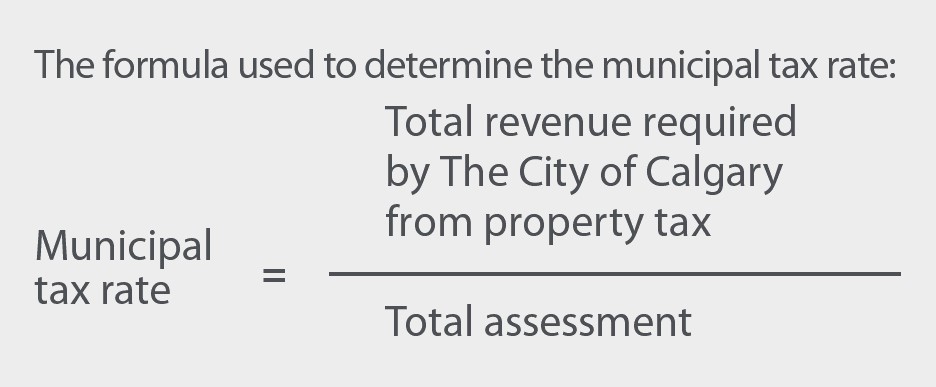

County property appraisers and county tax collectors for the purpose of calculating and documenting the refund due to a veteran or surviving spouse of a veteran under section 1960811b Florida Statutes for ad valorem taxes paid in the previous tax year on newly acquired property. Market and assessed values can be found on any Florida Countys Notice of Proposed Property Taxes. The estimated tax amount using this calculator is based upon the average Millage Rate of 200131 mills or 200131 and not the millage rate for a specific property.

Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business. Estimating Ad Valorem Property Taxes. It has been used in many states since the late 1940s and early 1950s to pay for redevelopment projects.

Refunds due under the statute are prorated as of the date of. To encourage job growth and new investment in Pinellas County on August 26 2014 Pinellas voters authorized the Pinellas County Board of County Commissioners to. Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business.

If you maintain the property as your primary residence you can receive an exemption of up to 50000 from the assessed value of your property. Non-ad valorem tax rolls are prepared by local governments and are certified to the tax collectors office for collection. However bank owned sales and short sales may be considered depending upon the.

TAVT is a one-time tax that is. There are some laws that limit the taxes due on owner-occupied homes in Florida. 1 Administer tax law for 36 taxes and fees processing nearly 375 billion and more than 10 million tax filings annually.

A lien against property. 3 Oversee property tax administration. The Tax Estimator allows you to calculate the estimated Ad Valorem taxes for a property located in Duval County.

An exemption is the amount that state law determines should be deducted from the assessed value of property for tax purposes. Ad valorem or property taxes are collected annually by the county tax collector. Tax Increment Financing often referred to as TIF is a method to pay for redevelopment of a slum or blighted area through the increased ad valorem tax revenue resulting from that redevelopment.

The results displayed are the estimated yearly taxes for the property using the last certified tax rate without exemptions or discounts. Often called property taxes Non-ad valorem Assessments. The Departments Florida Ad Valorem Valuation and Tax Data Book is a comprehensive summary of reported state- county- and municipal-level information regarding property value millages and taxes levied.

The Tax Amount shown is an ESTIMATE based upon the Sales Price you entered and the current ad valorem millage tax rate applied to the property. 1 Administer tax law for 36 taxes and fees processing nearly 375 billion and more than 10 million tax filings annually. Uniform throughout the jurisdiction.

On January 29 2008 Florida voters approved an additional 25000 homestead exemption to be applied to the value between 50000 and 75000. Pinellas County Property Tax Abatement for Economic Development. 2 Enforce child support law on behalf of about 1025000 children with 126 billion collected in FY 0607.

There are other exemptions. Annual Ad Valorem Tax Estimator Calculator Title Ad Valorem Tax TAVT The current TAVT rate is 66 of the fair market value of the vehicle. Market Value 16800 Property Class IV 15 Residence Location Vincent Shelby County State 65 County 75 SchoolOutside 300 Vincent 50 490 Millage Rate 491000049 2520 Assessed Value Market Value x Property Class Assessed Value.

Ad valorem 0025 x 90 of MSRP. This additional exemption does not apply to school taxes. The Property Tax Oversight PTO program publishes the Florida Ad Valorem Valuation and Tax Data Book twice.

Based on the assessed value of property. On the tax roll. Ad valorem ie according to value taxes are.

Florida Ad Valorem Valuation and Tax Data Book. Non-ad valorem assessments are primarily assessments for paving services storm water and solid waste collection and disposal. The typical homeowner in Florida pays 2035 annually in property taxes although that amount varies greatly between counties.

The collection of taxes as well as the assessment is in. A property tax millage rate of 35 mills for example would mean property with a taxable value of 100000 would pay 350 in property taxes. The states average effective property tax rate is 083 which is lower than the US.

Non-ad valorem assessments are. CRA Tax Increment Financing In Florida. Therefore you must add the school taxes back in to the Gross Tax amount approximately 20000.

Calculate the ad valorem tax for 12 months EXAMPLE. The sovereign right of local governments to raise public money. If you would like to calculate the estimated taxes on a specific property use the tax estimator on the.

This tax estimation tool is provided to assist any potential home or business owner with an estimate of the ad valorem property taxes on a new purchase for properties within the municipalities and unincorporated areas. Market Value Assessed Value New Property moving or moved Please note that bank owned sales and short sales are typically not considered market value indications. The taxable value is the assessed value minus exemptions.

Choose a tax districtcity from the drop down box enter a taxable value in the space provided then press the Estimate Taxes button. Ad valorem 15 cert 1 lien. The actual tax amount for this property may be more or less depending on a variety of factors including changes to the millage tax rate and the inclusion of non-ad valorem assessments eg.

This homestead exemption also provides for a cap on the amount your assessment can be increased from year to year.

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

What Is Cap Rate And How To Calculate It Infographic What Is Cap Real Estate Infographic Investment Property For Sale

Real Estate Property Tax Constitutional Tax Collector

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes

Capital Gains Tax Calculator 2022 Casaplorer

Car Tax By State Usa Manual Car Sales Tax Calculator

Rent Vs Buy Calculator Is It Better To Rent Or Buy Smartasset Com Retirement Calculator Property Tax Financial

Comparing The Real Cost Of Owning Property Across The United States Property Tax Real Estate Staging Denver Real Estate

Property Tax Tax Rate And Bill Calculation

Car Tax By State Usa Manual Car Sales Tax Calculator

Transfer Tax Calculator 2022 For All 50 States

How To Create An Income Tax Calculator In Excel Youtube

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Free Investment Property Spreadsheet For Tax This Spreadsheet Will Help You Calculate Your Income Investment Property Spreadsheet Template Budget Spreadsheet

Florida Income Tax Calculator Smartasset Com Property Tax Income Tax Tax

Tract Bc Lyttons Way Florida Keys Real Estate Real Estate Companies Open House