san antonio property tax rate 2019

Search Any Address 2. Which Texas Mega City Has Adopted The Highest Property Tax Rate San Antonio Property Tax Rate Cut.

Housing In San Antonio At Crossroads With Expired Downtown Incentive Policy New Council Members Elected San Antonio Heron

Search Valuable Data On Properties Such As Liens Taxes Comps Foreclosures More.

. Road and Flood Control Fund. San Antonio residents pay almost 57 cents in property taxes per every 100 dollars. In San Antonio the countys largest city and the second-largest city in.

Bexar County collects on average 212 of a propertys assessed fair. Anyone can apply for this Bexar. Atascosa County Appraisal District 4th Avenue J Poteet Texas 78065 830 742-3591.

The average homeowner in Bexar County pays 2721 annually in property taxes. Each unit then is given the tax it levied. Staff say the city has not raised the tax rate in 29 years and has lowered it seven times.

In San Antonio the countys largest city and the second largest city in the entire state the tax rate. Property Tax Per Capita 2019. Box 839950 San Antonio TX 78283.

San Antonio TX 78207. Throughout Bexar county of which San Antonio is the dominant player tax rates can. 77 rows Property Tax Rate Calculation Worksheets by Jurisdiction.

65 rows 2020 Official Tax Rates Exemptions. The average homeowner in Bexar County pays 2996 annually in property taxes on a median home value of 152400. San antonio property tax rate 2019 Sunday May 8 2022 Edit.

Higher home and property values in San Antonio could trigger a state law that requires cities in Texas to roll back the property tax rate if they generate too much money. Wed 07312019 - 1445. PersonDepartment 100 W.

Overall there are three phases to real estate taxation namely. The property tax rate for the City of San Antonio consists of two components. 14 rows City of San Antonio Print Mail Center Attn.

2019 Official Tax Rates. The law caps property taxes at 35 unless voters approve an increase or a disaster triggers a rate increase to 8. The citys current tax rate which accounts for about 22 of property tax bills is nearly 056.

2019 official tax rates exemptions. Bexar County lowered its tax rate last year to 304097 cents per 100 valuation. Property Tax Per Capita 2019 PropertyTax per Capitaxlsx.

The market values taxable values and tax rates are reported to the comptroller by each appraisal district. The effective tax rate for the city of San Antonio this year is 54266 cents per 100 valuation. Property Tax Per Capita 2019.

Alamo Community College District. Ad Find Out the Market Value of Any Property and Past Sale Prices. School taxes typically are the major component of a homeowners annual property tax bill typically ranging from about 50 to 60.

In the latest quarter it has been 247 which annualizes to a rate of 1024. If the city reduces its tax rate it would need the approval of council as it adopts is budget in. See Property Records Tax Titles Owner Info More.

The citys revenues for 2022 is. Setting tax rates appraising property worth and then receiving the tax. The median property tax in Bexar County Texas is 2484 per year for a home worth the median value of 117100.

The City of San Antonio has an interlocal agreement with the Bexar County Tax Assessor-Collectors Office to provide property tax billing and collection services for the City. Its currently set at 556 cents per 100 of valuation and brings in 30 percent of the citys. Keeping in mind that san antonios city property tax rate is 55 per hundred dollars eliminating this line item could be huge and it is in many areas.

Greg Abbott signed the new law Senate Bill 2 in 2019 and it took effect in 2021 when the citys property tax revenues increased by 31. For questions regarding your tax statement contact the Bexar County Tax Assessor-Collectors Office at. Alternatively the city could exceed the revenue cap but doing so would trigger an.

If your home is valued at 150000 and you qualify for a 25000 exemption you would only pay taxes on the home as if it were worth 125000. This allows for a different tax rate for branch campuses in those school districts. 1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title.

2018 Official Tax Rates.

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

All Of Us Are At A Breaking Point San Antonio Bexar County Leaders Look To Austin For Property Tax Relief

11179 Candle Park San Antonio Tx 78249 Realtor Com

San Antonio Could Roll Back Its City Property Tax Rate Due To Higher Projected Revenues Tpr

San Antonio Property Tax Rate Cut Homestead Exemption Increase Mulled

Everything You Need To Know For A San Antonio Vacation

Is San Antonio Safe Top 10 Most Dangerous Places

San Antonio Property Tax Rate Cut Homestead Exemption Increase Mulled

10 Best Places To Retire Flyer Postcard Best Places To Retire Flyer Postcard

San Antonio Texas Tx Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

San Antonio Trip Planner A Guide To San Antonio

Which Texas Mega City Has Adopted The Highest Property Tax Rate

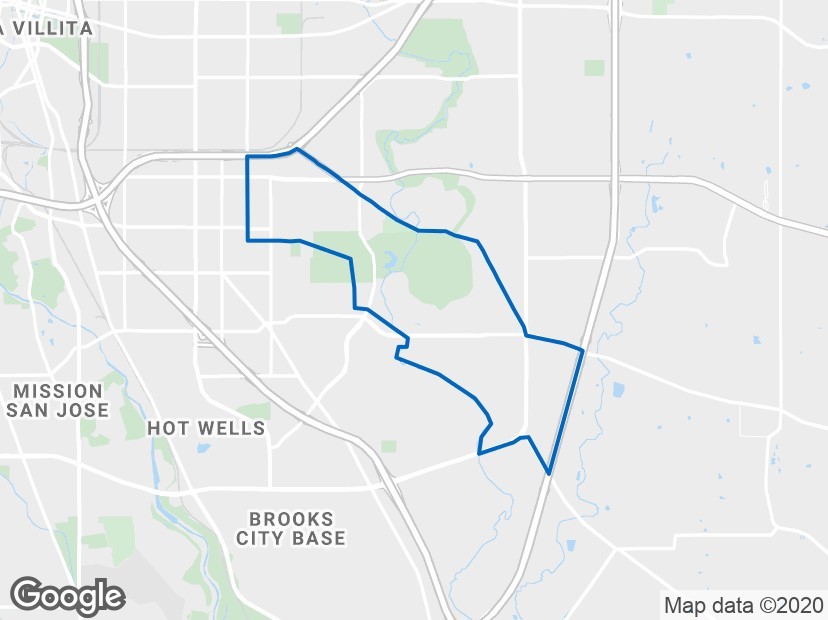

City Council District 2 Candidates Answer Your Questions Ahead Of San Antonio S May 1 Election

San Antonio Texas Tx Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

San Antonio Texas Tx Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption