modified business tax rate nevada

The tips below can help you fill out Nevada Modified Business Tax quickly and easily. On May 13 2021 the Nevada Supreme Court upheld a decision that the biennial Modified Business Tax rate adjustment was.

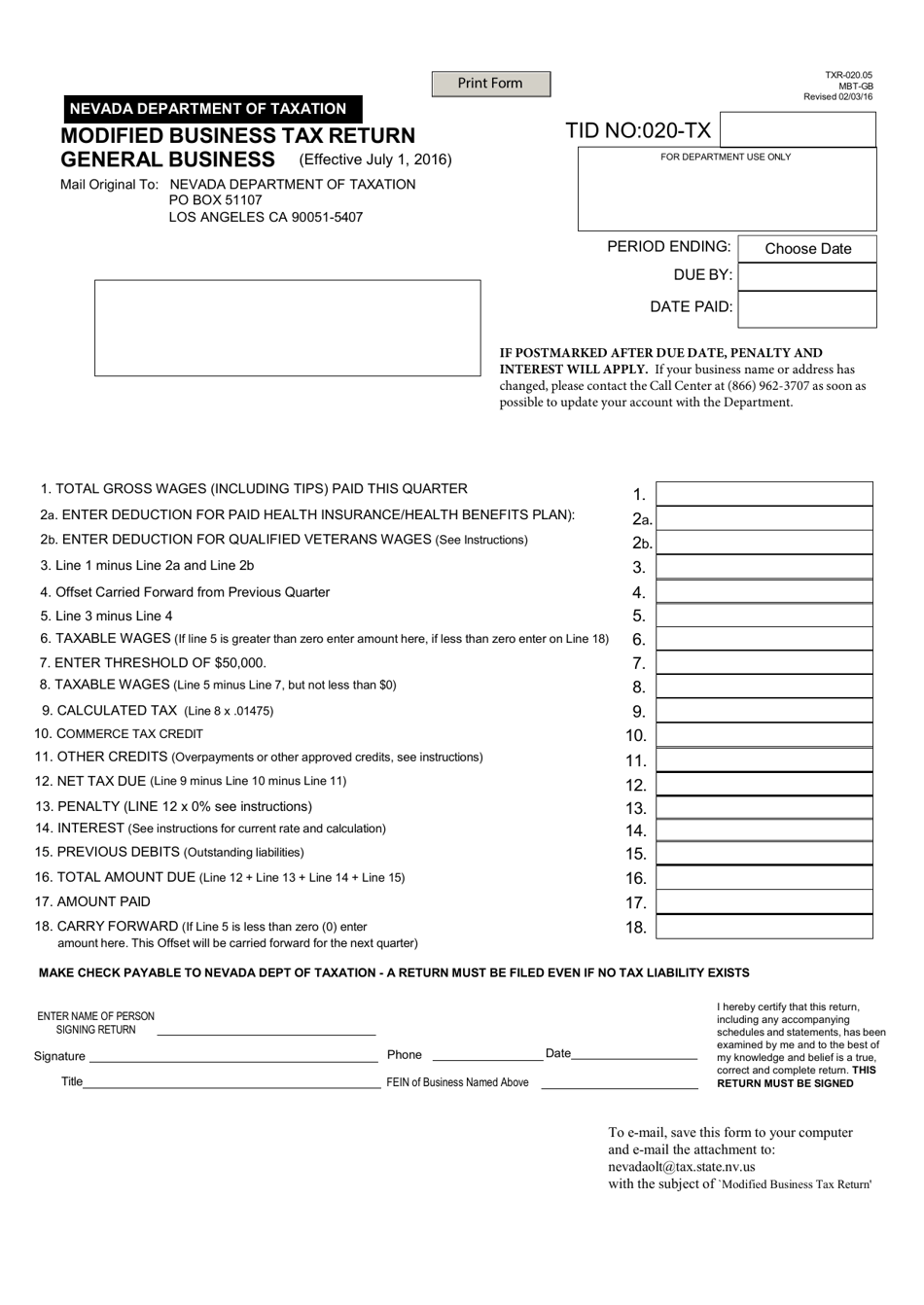

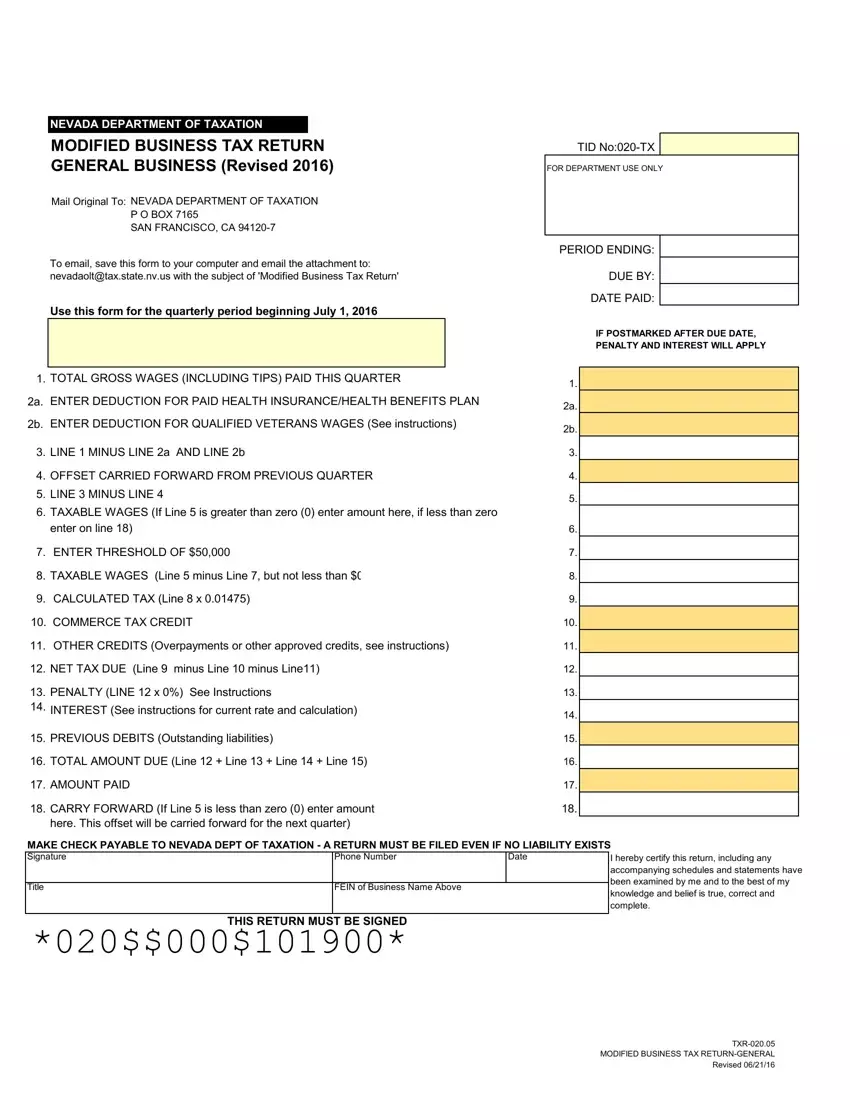

Ad Download Or Email NV TID 020-TX More Fillable Forms Register and Subscribe Now.

. Imposition - A excise tax at the rate of 2 of the wages paid by the employer during a calendar quarter. Now Prep Your Signature. In 2015 legislation was enacted to reduce both MBT rates if general tax revenues exceeded a.

Nevada Modified Business Tax Rate. Nevada levies a Modified Business Tax MBT on payroll wages. As we mentioned earlier there is no corporate income tax rate in Nevada.

Henderson Nevada 89074 Phone. Complete the necessary fields. Tax Bracket gross taxable income Tax Rate 0.

NRS 363A130 Allowable Credit 50 of the amount of Commerce Tax paid in the. On May 13 2021 the Nevada Supreme. But remember your business is still liable for federal taxes.

However the first 50 000 of gross wages is not taxable. 10 -Nevada Corporate Income Tax Brackets. Effective July 1 2019 the tax rate changes.

702 486-3377 MODIFIED BUSINESS TAX REFUND NOTICE Dear Taxpayer During the 2019 Legislative Session Senate. The previous tax was set at 117 above an exemption level of 85000 per quarter although certain industries. Nevada has a 685 percent sales tax rate and a max local rate of 153 percent with an average combined state and local sales tax rate of 823 percent.

Employers subject to Nevada Unemployment are also subject to the Modified Business Tax on total gross wages less employee health care benefits paid by the employer. During the 2019 Legislative Session Senate Bill 551 was passed which repealed the biennial Modified Business Tax rate adjustment. The modified business tax MBT is considered a payroll tax based on the amount of wages paid out in a quarter.

This is the standard quarterly return for reporting the Modified Business Tax for Financial Institutions as defined by NRS 360A050. The Nevada business tax as defined for the general business category is pursuant to NV Rev Stat 363B 2017. The Nevada Supreme Court determined the Modified Business Tax MBT rate should have been reduced on July 1 2019.

There is one general rate 1475 percent and a higher rate for financial institutions 20 percent. This is after the deduction of any health. Modified Business Tax Statistics Please note the following figures are based on tax-paying businesses only and are not a complete representation of total Nevada gross wages Quarterly.

Open the document in the full-fledged online editor by hitting Get form. Nevada has no corporate income tax at the state level making it an attractive tax. Modified Business Tax Changes and.

Creighton said any digital. Since the passage of the Tax Cuts and. For example if the sum of all wages for the 9 15 quarter is 101 000 after health care and qualified veteran wage.

The tax rate is 1475 on wages. According to the court a bill that was passed during. Nevada Unemployment Insurance Modified Business Tax If youre starting a new small business congratulations you should use 295.

Does Qb Offer The Nv Modified Business Tax Payroll Form

Modified Business Tax Return Form Nevada Fill Online Printable Fillable Blank Pdffiller

Form Txr 020 05 Download Fillable Pdf Or Fill Online Modified Business Tax Return General Business Nevada Templateroller

Ask The Advisors Basic Tax Academy State Of Nevada Department Of Taxation Ppt Download

Fillable Online Modified Business Tax Return General Businesses Form Fax Email Print Pdffiller

Modified Business Tax Form Fill Out Printable Pdf Forms Online

Nevada Taxes Will The Tax Man Cometh To Carson City In 2023 Nbm

What Is The Business Tax Rate In Nevada

First Round Of Nevada Modified Business Tax Refunds Issued Serving Northern Nevada

Modified Business Tax Return Form Nevada Fill Online Printable Fillable Blank Pdffiller